Search Suggestions

- Gold Loan

- Money Transfer

- Mutual Funds

WHY ARE REGULAR REPAYMENTS IMPORTANT FOR GOOD FINANCIAL HEALTH

Your financial health is as important as physical health. In fact, it is more so because the distress of the bad finances can put a strain on you emotionally, mentally, and eventually physically.

Keeping good financial health is no hard science. Timely repayment of loans is one the best ways to keep you financially sound as it also builds up your banking credibility. A series of scheduled payments known as EMIs, which consist of both the principal and interest part, is typically the mode of loan repayments.

To have a good grasp on the subject and to ensure sound financial health, let us delve into the subject of:

- Loans

- Importance of Calculating Loan Repayments

- Implications of Delay in Loan Repayments

- Benefits of Regular Repayments

What are the Main Types of Loans?

Secured Loans

A type of loan in which you pledge collateral to the lender in exchange for the funds. A few examples of this loan are a home loan, a loan against property, etc.

Unsecured Loans

Before offering this type of loan, the lenders don’t ask for any collateral. You get the sanctioned funds after only providing the required documents, including identity proofs, income proofs, etc. A few examples of this loan are personal loans, auto loans, credit cards, etc.

Because there are chances of default, the lenders charge fees as an interest to offset the risk on these loans. As the unsecured loans are without any collateral, these loans come with a higher rate of interest, unlike secured loans where the lenders have the right to take possession of the pledged asset in case of a default.

Why Calculating Loan Repayments is Important?

Calculating repayments of home loans, personal loans,or any other type is crucial for both, the lender and the borrower. It helps understand the correct breakup of an EMI, which is the combination of a part of principal amount and interest amount.

These fixed equated monthly installments (EMIs) are taken out from the bank account of the borrower on a fixed date of the month to repay the principal and interest until both become zero.

At the initial stage of loan repayment, the interesting part is higher in an EMI, while the later stage sees an increase in the principal part, and the EMI amount remains the same throughout the process of repayment.

The lender shares a loan repayment schedule with the borrower to help understand and calculate the repayment. It shows the breakdown of each EMI with separate principal and interest repayment amounts.

What are the Implications of Delay in Loan Repayments?

Loans, with their quick disbursals and immediate assistance, are helpful at the time of financial distress. However, defaulting on loan repayments can adversely affect you in the following ways:

- Late Payment Charges: A delay in scheduled EMI creates an additional dent in your pocket. Lenders can levy up to 24-48% penalty on the overall balance in addition to bounced ECS or cheque charges.

- Severely Impacts Credit Score: Any delay or a miss of an EMI reflects in the credit report, which can be seen by all the lenders. This irregularity would make them cautious to lend you loans in the future, may offer you higher interest rates, or worse, reject your application in the time of need.

- Lender Taking Legal Course of Action: In case there is no repayment of debt taken, the loan can turn as non-performing asset (NPA), especially in an unsecured loan, the lender makes every effort to recover the amount, like sending a legal warning or a collection agent to visit you, which can be a stressful and embarrassing event.

- Losing Your Pledged Asset: Especially in the case of secured loans, irregularity in loan repayments eventually turns the account NPA, which may allow the lender to take possession of your pledged collateral, and sell it to recover their dues. It could be a huge loss to you as it permanently damages your credit history too.

How Can Regular Repayments Be Beneficial?

In addition to preventing the clear implications of irregular or defaulting on loan repayments, regular repayments can hugely benefit borrowers in the following ways too:

- A Borrower gets the best offers and deals from various banks, NBFCs, and private lenders, as regular repayments are considered a healthy financial habit.

- With regular repayments, the competitor banks may offer you to transfer the balance of your ongoing loan to them at reduced interest rates. It can help save you a good sum while repaying a loan.

- Regular repayments will keep you stress-free regarding your finances and debts. It will help build a happier and peaceful mindset, which results not only in good financial health but mental and physical health as well.

With the unpredictability of circumstances and medical and cash emergencies suddenly turning up, loans can be the affordable way to handle the immediate financial crisis. A disciplined repayment of loans makes sure you always get access to them, most securely. It will help you not only on a rainy day but throughout the thick and thin of life.

At Muthoot Finance, we pledge to bring joy to millions through our diversified financial services, such as Gold Loan, Personal Loan, Big Business Loan, Vehicle Loan, Mutual Funds, Digital & Cashless, and much more, with a transparent process, flexible repayment terms, and best interest rates. We are India's No. 1 Most Trusted Financial Services Brand*, also dedicated to finding all possible ways to assist our customers in repayments. Visit our website to know more.

- Instant Personal Loan

- EMI Calculator

- Document Required

- Track Personal Loan

- Interest Rate

- Procedure and Eligibility

CATEGORIES

OUR SERVICES

-

Credit Score

-

Gold Loan

-

Personal Loan

-

Cibil Score

-

Vehicle Loan

-

Small Business Loan

-

Money Transfer

-

Insurance

-

Mutual Funds

-

SME Loan

-

Corporate Loan

-

NCD

-

PAN Card

-

NPS

-

Custom Offers

-

Digital & Cashless

-

Milligram Rewards

-

Bank Mapping

-

Housing Finance

-

#Big Business Loan

-

#Gold Loan Mela

-

#Kholiye Khushiyon Ki Tijori

-

#Gold Loan At Home

-

#Sunherisoch

RECENT POSTS

Struggling with low CIBIL? Here’s How a Gold Loan Can Still Get You Funded

Know More

What is a Top-Up Loan? Eligibility Criteria Explained

Know More

Top Factors That Influence Mortgage Loan Interest Rates

Know More

What is a Loan Against Mutual Funds and How Does it Work?

Know More

What is Working Capital? Meaning, Formula & Importance

Know More

Understanding KDM Gold and Why it’s Banned

Know More

Gold loan boom: 3,000 new branches to open in India in 12 months

Know More

Gold Loan Boom: Rs 14.5 lakh crore market spurs NBFCs to add 3,000 branches

Know More

How BNPL Affects Your Credit Score

Know More

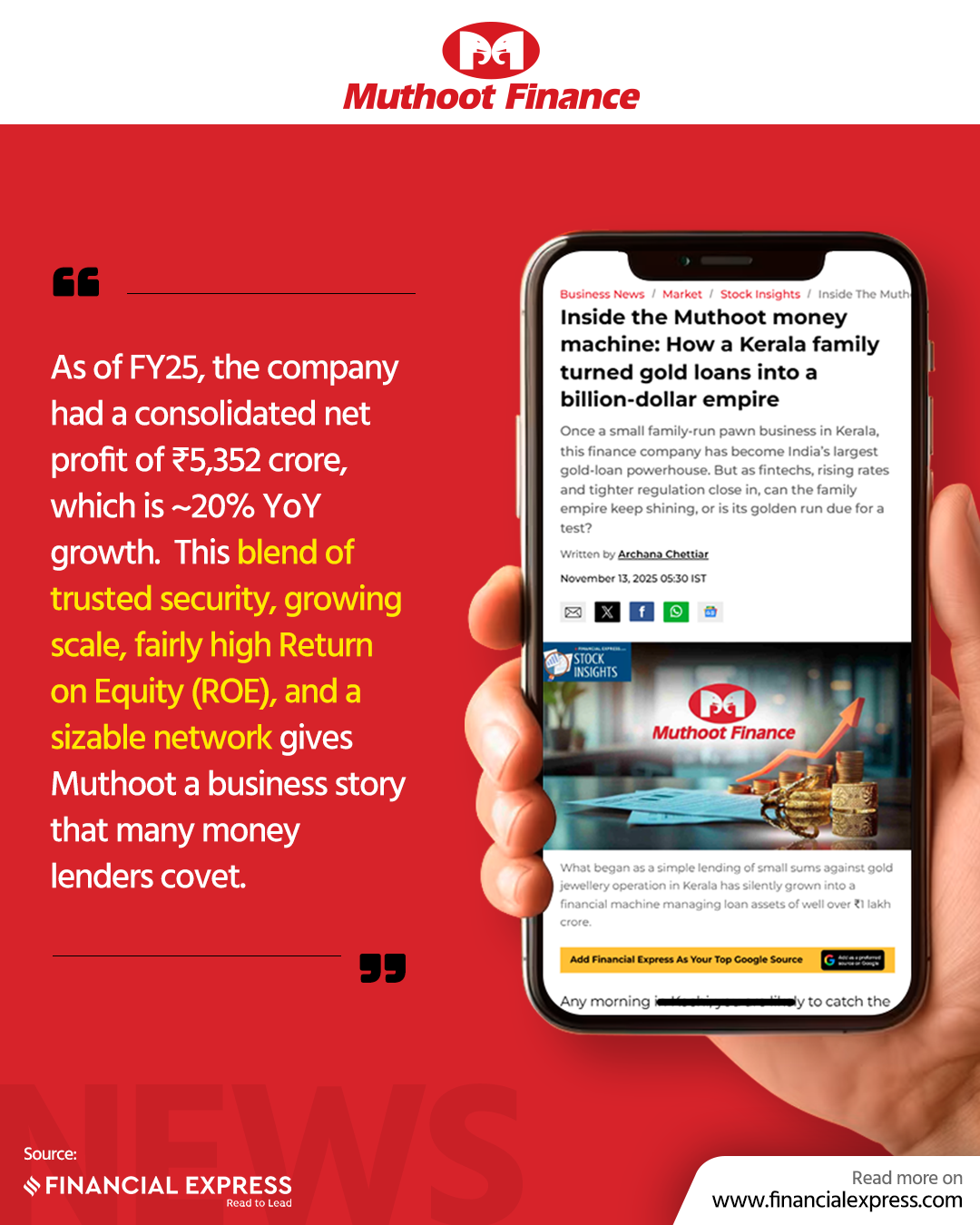

Inside the Muthoot money machine: How a Kerala family turned gold loans into a billion-dollar empire

Know MoreFIN SHORTS

What Are Co-Pay and Deductibles in Insurance Policies?

Know More

Should You Take a Loan Against Your Mutual Fund or SIP?

Know More

Top 5 Best Mid-Cap Mutual Funds to Watch in 2026

Know More

Are Personal Loans Right for Retirees? Key Points to Consider

Know More

What Happens to a Personal Loan After the Borrower Dies?

Know More

Best Loan Choices for Credit Scores of 580 and Below

Know More

7 Reasons Why a Gold Loan Is the Best Option for Small Businesses

Know More

10 Reasons Why People in India Prefer Physical Gold

Know More

Real Estate vs Gold: Which Is a Better Investment in India?

Know More

10 Common Mistakes That Make Investors Lose Money in Mutual Funds

Know More

10 Reasons Why Gold Has So Much Appeal in Uncertain Times

Know More

7 Ways Settling Debt Can Impact Your CIBIL Score

Know More- South +91 99469 01212

- North 1800 313 1212