Search Suggestions

- Gold Loan

- Money Transfer

- Mutual Funds

Calculate Compound Interest in Seconds (2025)

Compound interest refers to earning interest not only on the principal amount you invested but also on the interest that builds up over time. This helps your money grow faster because interest is added every time, which increases the total amount that earns more interest.

Table of Content

- Understanding Compound Interest Calculator

- What is the Compound Interest Formula?

- How to Calculate Compound Interest?

- How Can a Compound Interest Calculator Help You?

- Benefits of Using the Compound Interest Calculator

CI is a popular method for growing wealth over a long period and is often used in financial planning. To find out how much your investment will increase, it is recommended to use a reliable compound interest calculator.

Understanding Compound Interest Calculator

A compound interest calculator is a useful tool that helps you find out how much money you will earn over your initial investment over time.

It works by including the interest you earned and adding it back to your investment, so you earn interest on the increasing amount. You just need to enter some details such as how much you are investing, interest rate, how often interest is added (e.g. monthly or annual), and duration. This makes it easy to see how your money increases and helps you make smart financial decisions.

What is the Compound Interest Formula?

Here is the formula for compound interest

A = P (1 + r/n) ^ nt

Here,

A refers to Compound Interest

P refers to the Principal Amount

R refers to the Rate of interest

n refers to the Number of times interest compounds yearly

t refers to the Duration in years

How to Calculate Compound Interest?

As mentioned above, you can check compound interest using a formula, and here is a simple example to help understand how it works.

Suppose you invest ₹10,000 at an annual interest rate of 15% for 5 years, with interest compounded once every year. In the first year, you will earn ₹ 1,500 (which is 15% of ₹ 10,000).

For the second year, interest is calculated at ₹ 11,500 (₹ 10,000 + 1,500), giving you ₹ 1,725. Now the total is ₹ 13,225. In the third year, interest is calculated on this amount, and the process continues. By the end of 5 years, your total investment increases by approx.₹ 20,114.

Here is the same example, and use the compound interest formula

A = P (1 + r/n) ^ nt,

P = ₹10,000

r = 15% = 0.15

n = 1

t = 5

A = 10,000 (1+0.15)^5

= ₹20,113.57

As you can see, doing these calculations manually can be time-consuming and inconvenient, especially for long periods. This is why it uses a compound interest calculator makes it much easier and helps avoid mistakes.

How Can a Compound Interest Calculator Help You?

A compound interest calculator is an easy tool that helps you see how your money can grow over time. The calculator shows how your savings can increase by planning to invest your initial amount, interest rate, and how long you plan to invest. This is particularly useful when you are saving for large goals such as retirement or education.

Unlike simple interest, compound interest lets you earn interest on both your original amount and the interest you have already earned. This can help you save more in the long run. By using this tool, you can focus on savings, choose smart investment options and set attainable financial goals.

Benefits of Using the Compound Interest Calculator

Using a compound interest calculator online offers several advantages that can greatly assist you in your financial planning:

Accurate Projections

This compound interest calculator uses mathematical formulas to give you a figure of how your money increases over time, taking into account both the initial amount and the compounding effect. However, keep in mind that it does not factor in market changes.

Customisable Inputs

You can try various scenarios by adjusting numbers such as investment amount, interest rate, period and compounding frequency. This helps you understand how different variables affect your final savings.

Financial planning

The CI calculator is a great resource to manage and plan your finances. You can use it to determine savings goals, monitor your progress and refine your investment strategies related to personal loans based on your financial objectives.

Time-saving

Instead of manually calculating complex calculations, this tool gives you quick and accurate results, which helps you avoid errors and save time.

Suggested Read: How Compounding Works in Mutual Funds

In summary, a compound interest calculator is a beneficial tool that makes it easy for people to make smart financial decisions. This gives quick and accurate results on how much interest you can earn or need to pay. Whether you are planning to take a loan, checking potential returns from mutual funds, or trying to manage your savings, this tool simplifies complex calculations and helps you understand your finances better.

- Instant Personal Loan

- EMI Calculator

- Document Required

- Track Personal Loan

- Interest Rate

- Procedure and Eligibility

CATEGORIES

OUR SERVICES

-

Credit Score

-

Gold Loan

-

Personal Loan

-

Cibil Score

-

Vehicle Loan

-

Small Business Loan

-

Money Transfer

-

Insurance

-

Mutual Funds

-

SME Loan

-

Corporate Loan

-

NCD

-

PAN Card

-

NPS

-

Custom Offers

-

Digital & Cashless

-

Milligram Rewards

-

Bank Mapping

-

Housing Finance

-

#Big Business Loan

-

#Gold Loan Mela

-

#Kholiye Khushiyon Ki Tijori

-

#Gold Loan At Home

-

#Sunherisoch

RECENT POSTS

Differences Between Loans and Bonds

Know More

MCLR vs EBLR - Which One Saves More on Home Loans?

Know More

SIP vs SIF Fund: Meaning, Differences and Best Mutual Fund Option

Know More

Mudra Loan vs MSME Loan: Key Differences Every Small Business Owner Must Know

Know More

Daily SIP vs Monthly SIP: Which is Better?

Know More

How to Invest in NPS: Step-by-Step Guide for Beginners

Know More

Deferred Payment Meaning, Examples & How It Works in Personal Loans?

Know More

Gold Price Hits Record High: What It Means for Your Gold Loan?

Know More

Difference Between NPS and Mutual Funds

Know More

Difference Between Primary Security and Collateral Security in Business Loan

Know MoreFIN SHORTS

Difference Between Personal Loan and Consumer Durable Loan

Know More

Checklist Before Applying for Gold Loan Online

Know More

5 Steps To Get Your Business Ready For An Sme Loan

Know More

5 Solid Reasons To Choose Sip Over Fixed Deposits

Know More

5 Best Mutual Fund For Retirement 2025

Know More

Are Commercial Vehicle Loans Beneficial?

Know More

Why Digital Gold Loans Are Gaining Traction in 2025

Know More

Gold Price Forecast for the Next 6 Months

Know More

Why Travel Is Now the Top Reason for Indians to Take Personal Loans

Know More

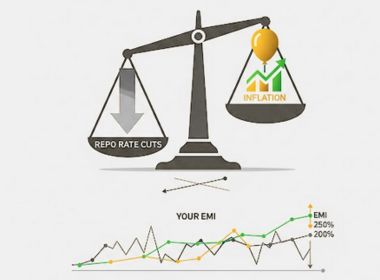

Repo Rate Cuts, Inflation, and Your EMI: Navigating Personal Loans in 2025

Know More

A ₹10,000 SIP Could Turn into Crores?

Know More

NPS Repairs: 6 Big Reforms Everyone Should Know

Know More- South +91 99469 01212

- North 1800 313 1212