Search Suggestions

- Gold Loan

- Money Transfer

- Mutual Funds

7 Key Factors to Consider Before Taking an SME Loan

It takes money to make money, which is why capital is often the backbone of many businesses. Whether covering operating expenses, expanding operations, or investing in new equipment, it is not unusual for businesses to require funds. When in need, small businesses often turn to an SME (Small and Medium Enterprises) loan to bridge their capital shortcomings.

However, while availing an SME loan has become quite easy in the past few years, there are still some factors that one needs to consider to ensure a hassle-free borrowing experience.

What is an SME Loan?

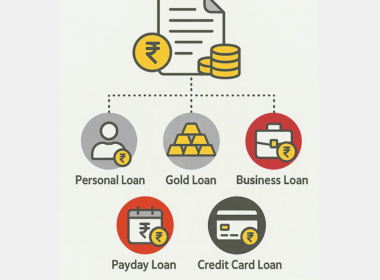

SME loans are a type of loan offered by lenders to small or medium-sized businesses to invest in their operations and business growth. The loan provides funding for scaling operations, hiring talent, and exploring new market opportunities. They can be both secured and unsecured. In India’s growing entrepreneurial spirit, these business loans help entrepreneurs achieve their goals, while also boosting the country’s economy.

Factors to Consider Before Taking an SME Loan

Here are some key factors to keep in mind while taking an SME loan:

- Identify Your Purpose for Availing the Loan

Before you avail a business loan, always identify the purpose behind borrowing the money. Whether it’s for expanding your business or buying new equipment, knowing the purpose will help you decide the right loan amount.

If you borrow too much, you will incur extra interest rates. On the other hand, if you borrow too little, it will hinder your business plans. Ultimately, deciding the right loan amount beforehand will ensure your loan supports your goals without creating unnecessary financial strain.

- Have a Business Plan in Place

Beyond knowing the purpose of availing your plan, it is also important to have a business plan in place, as lenders prefer applicants who have vision. You should also create a presentation detailing your business, its objectives and how the capital you are borrowing will help in achieving these objectives. This way, you will clearly demonstrate how you plan to use the loan to achieve your goals.

- Check Your Credit Score

Another key factor to keep in mind while availing a business loan is the CIBIL score. While your personal credit score should not have a bearing on your eligibility for SME loans, there are some instances where the lender will review your credit history before approving the loan. For instance, if you are a new business owner who is just starting, the lender will review your credit score to understand your repayment history. The same is also true for situations where a business is borrowing for the first time with a lender.

- Compare Different Lenders

Comparing lenders is a crucial factor for SME loans, as different lenders often have different loan terms. Compare lenders based on the interest rates, tenures, processing fees, reviews and charges, and choose one that best aligns with your business goals. You should also compare lenders across public and private banks, fintech companies, and explore government schemes like PM Mudra Yojana for better rates.

- Decide Between Secured vs. Unsecured Loan

Understanding the difference between secured and unsecured SME loans is crucial for making the right decision. Secured loans are those that require collateral, such as property or equipment, to back the loan. On the other hand, unsecured loans do not require collateral and are based on a business's creditworthiness, financials, and repayment history. While unsecured loans are easier to obtain, they often come with higher interest rates, making it challenging for businesses seeking long-term growth.

- Understand the Eligibility and Documentation

Check the eligibility criteria for the SME loan before applying. This way, you will be able to avoid too many loan inquiries in a short period of time, which will negatively impact your credit score in the long term. Besides eligibility, also make sure to gather all your loan documents in advance for a smooth application process. Generally, most lenders ask for documents, such as a business PAN card, address proof, bank statements, tax return proof, and more.

- Have a Loan Repayment Strategy

Repayment is a crucial part of the loan cycle, making it necessary to have a repayment strategy in place. Here is what you can do:

- Understand your business’s cash flow and decide how much you can comfortably allocate towards the loan repayment.

- In case you have surplus money, use it towards your repayment to reduce the principal amount, thus saving on interest.

- If you have multiple loans, pay the one with the highest interest rate first.

- To pay the loan faster, you can also opt for biweekly payments instead of monthly.

Suggested Read: SME Loan - Meaning, Eligibility, and Things to Remember

In conclusion, securing an SME loan can be a game-changer for many businesses, allowing them to pursue their goals without worrying about the finances. However, to successfully navigate the loan process and increase your chances of approval, it is important to keep the discussed factors in mind before you apply.

At Muthoot Finance, we understand the need of SMEs for financing, and thus offer flexible, collateral-free SME loans to help them achieve their goals. Our application process is streamlined, with quick approvals and reimbursement, making securing the funds you need easier than ever. For more information, visit your nearest Muthoot Finance branch.

CATEGORIES

OUR SERVICES

-

Credit Score

-

Gold Loan

-

Personal Loan

-

Cibil Score

-

Vehicle Loan

-

Small Business Loan

-

Money Transfer

-

Insurance

-

Mutual Funds

-

SME Loan

-

Corporate Loan

-

NCD

-

PAN Card

-

NPS

-

Custom Offers

-

Digital & Cashless

-

Milligram Rewards

-

Bank Mapping

-

Housing Finance

-

#Big Business Loan

-

#Gold Loan Mela

-

#Kholiye Khushiyon Ki Tijori

-

#Gold Loan At Home

-

#Sunherisoch

RECENT POSTS

What is a Digital Wallet: Meaning, Types, Examples & Benefits

Know More

What is Refinancing: Meaning, Types, Benefits & Examples

Know More

What Is a Debt Trap? Meaning, Causes & How to Avoid It

Know More

Gold Price Forecast 2026: Will Gold Prices Rise or Fall?

Know More

What Is Capital Gains Tax in India? Meaning, Types & Tax Rates

Know More

Best Index Funds to Invest in India in 2026

Know More

Understanding Gold Bees: How it Works, Net Asset Value, Returns and More

Know More

Multi Cap and Flexi Cap Mutual Funds: How Are They Different?

Know More

Online Personal Loan vs. Offline Personal Loan - Which Is Better for You?

Know More

10 Tips to Improve Chances of Personal Loan Approval

Know MoreFIN SHORTS

What Is a Gold Loan and Who Should Consider It?

Know More

How Does a Gold Loan Work? A Simple Step-by-Step Guide

Know More

How to Link Your Mobile Number with PAN Card Step-by-Step Guide

Know More

Is a PAN Card Mandatory for a Gold Loan? Rules Explained

Know More

Can You Have Multiple Personal Loans at the Same Time?

Know More

Why Is Gold Sustaining Near ₹1.5 Lakh? Key Reasons Explained

Know More

The Best 7 SIF Funds of 2026: A Better Way to Invest

Know More

Gold Price Hits ₹1,40,000: How It Impacts Gold Loan Amounts

Know More

How to Check Loan Number: Step-by-Step Process

Know More

How to Open an SIP Account: Online and Offline Process

Know More

How Do I Apply for MSME Certification Online in India?

Know More

7 Important Reasons to Choose Hallmark Gold When Buying Jewellery

Know More- South +91 99469 01212

- North 1800 313 1212