Search Suggestions

- Gold Loan

- Money Transfer

- Mutual Funds

Working Capital Loan- Meaning, Types & Examples

It is of utmost importance that businesses have the right financial tools for their growth and stability. The difference between a business organisation’s current assets and current liabilities on its balance sheet is called working capital. For long-term sustainability of any business, working capital plays an important role. It is required for the day-to-day operational costs and other financial obligations of a business. Working capital loans could be the main driving force for businesses to thrive if they lack enough working capital to address their needs in an ever-evolving market.

Table of Content

It serves as a financial avenue to address the challenges faced by businesses. Working capital loans, much like other forms of individual loans, require a good credit history and a good CIBIL score. You can avail of a small business loan from Muthoot Finance, which serves as an immediate business working capital need or for the expansion of your business.

What is a Working Capital Loan?

It is a type of small business loan that is designed for business enterprises to cover short-term financial obligations such as paying wages to your employees, inventory, utility bills, and covering payable accounts. In simple terms, working capital is what keeps your boat afloat.

To avail working capital, you can apply for a small business loan at Muthoot Finance and can use the working capital loan calculator to have a better understanding of the EMI you are liable to pay, depending on the loan amount and the tenure. Initially, businesses do not generate enough revenue to keep themselves functioning, and this is the case with seasonal businesses that may need a working capital loan so that they can keep functioning with the hope of seizing opportunities in future. Some of the key features of working capital loans are.

- Easy loan application procedure

- Shorter repayment tenure

- Quick Loan Disbursal

- Limited period of EMIs

- Small loan amount

Suggested Read: Working Capital vs. Term Loan - All You Need to Know from A Business Perspective

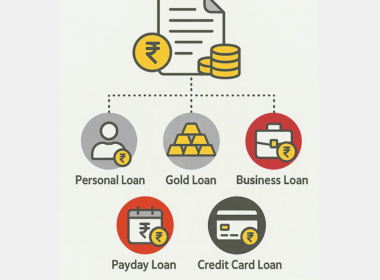

Different Types of Working Capital Loans

Working capital loans come in various types for you to avail. They are: -

Overdraft

These types of working capital loans are an ideal option for business owners, irrespective of the size of their business. Even though this option offers flexibility with borrowing, your lender will offer an account with an overdraft facility that has a credit limit on it. You can withdraw the loan amount depending on your needs and pay your working capital loan with an interest rate only on the amount you have utilised.

Cash Credit

This is very similar to the overdraft facility type due to its pre-determined credit limit feature, which is granted to businesses for bridging the gap, i.e. lack of enough working capital. It is granted against the collateral that a borrower pledges. The main objective of cash credit is to help businesses maintain a smooth cycle. The collateral can be in the form of stock-in-trade, work-in-process, finished goods, etc.

Invoice Financing

For example, a manufacturing company or a business may face a lack of funds as a result of delayed payments from its customers. In such cases, the manufacturer or the seller can then show unpaid invoices to their lender to avail of the working capital loan. Due to its nature of simplicity, it is considered the most popular SME loan for working capital requirements.

Letter of Credit

A Letter of Credit is a type of monetary guarantee offered by the lender to both parties involved in a transaction. It is issued on the buyer’s instruction, where the buyer’s financial institution agrees to pay the seller when certain conditions are met. These are non-funds based working capital loans, which makes them an ideal option in international trade because both parties may know each other well.

Turnover-Based

These types of working capital loans provide you with access to instant funds. However, it is determined based on your business's turnover. Among the diverse finance solutions for working capital stated above, the turnover-based loans are considered to be one of the best options due to their hassle-free approach.

Suggested Read: Fixed Capital vs. Working Capital Loan: Which is Right for Your SME?

Muthoot Finance is constantly working to facilitate financial aid to businesses by offering working capital loans in the form of small business loans. This initiative is taken with the intent to help businesses flourish. And in its entirety, it is a step towards building the business economy in India.

CATEGORIES

OUR SERVICES

-

Credit Score

-

Gold Loan

-

Personal Loan

-

Cibil Score

-

Vehicle Loan

-

Small Business Loan

-

Money Transfer

-

Insurance

-

Mutual Funds

-

SME Loan

-

Corporate Loan

-

NCD

-

PAN Card

-

NPS

-

Custom Offers

-

Digital & Cashless

-

Milligram Rewards

-

Bank Mapping

-

Housing Finance

-

#Big Business Loan

-

#Gold Loan Mela

-

#Kholiye Khushiyon Ki Tijori

-

#Gold Loan At Home

-

#Sunherisoch

RECENT POSTS

What is a Digital Wallet: Meaning, Types, Examples & Benefits

Know More

What is Refinancing: Meaning, Types, Benefits & Examples

Know More

What Is a Debt Trap? Meaning, Causes & How to Avoid It

Know More

Gold Price Forecast 2026: Will Gold Prices Rise or Fall?

Know More

What Is Capital Gains Tax in India? Meaning, Types & Tax Rates

Know More

Best Index Funds to Invest in India in 2026

Know More

Understanding Gold Bees: How it Works, Net Asset Value, Returns and More

Know More

Multi Cap and Flexi Cap Mutual Funds: How Are They Different?

Know More

Online Personal Loan vs. Offline Personal Loan - Which Is Better for You?

Know More

10 Tips to Improve Chances of Personal Loan Approval

Know MoreFIN SHORTS

What Is a Gold Loan and Who Should Consider It?

Know More

How Does a Gold Loan Work? A Simple Step-by-Step Guide

Know More

How to Link Your Mobile Number with PAN Card Step-by-Step Guide

Know More

Is a PAN Card Mandatory for a Gold Loan? Rules Explained

Know More

Can You Have Multiple Personal Loans at the Same Time?

Know More

Why Is Gold Sustaining Near ₹1.5 Lakh? Key Reasons Explained

Know More

The Best 7 SIF Funds of 2026: A Better Way to Invest

Know More

Gold Price Hits ₹1,40,000: How It Impacts Gold Loan Amounts

Know More

How to Check Loan Number: Step-by-Step Process

Know More

How to Open an SIP Account: Online and Offline Process

Know More

How Do I Apply for MSME Certification Online in India?

Know More

7 Important Reasons to Choose Hallmark Gold When Buying Jewellery

Know More- South +91 99469 01212

- North 1800 313 1212